Kwsp Employer Contribution Rate

Minimum employers share of epf statutory contribution rate for employees above age 60 who are liable to contribute will be reduced to 4 per month while the employees share of contribution rate will be 0.

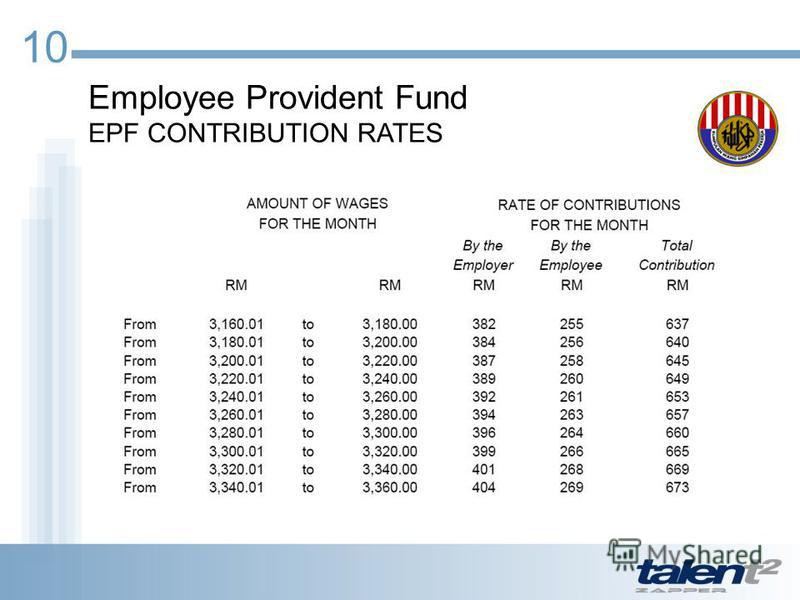

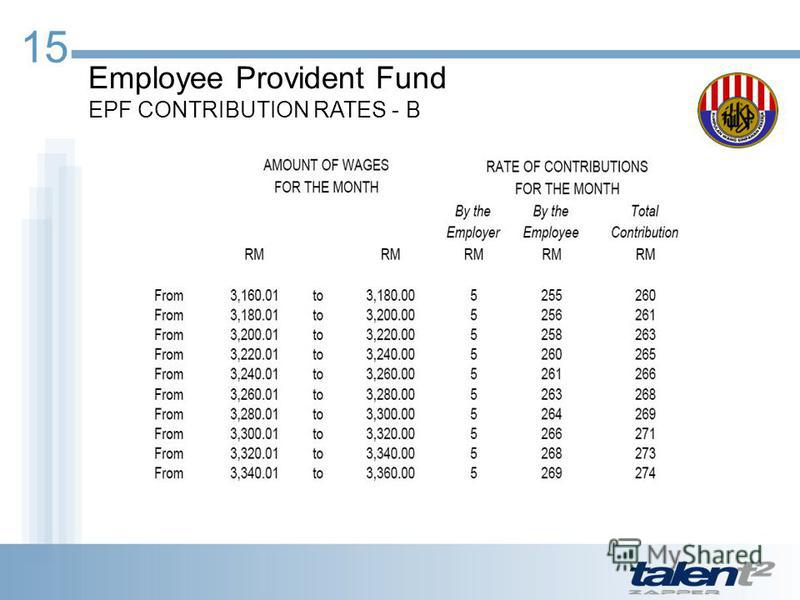

Kwsp employer contribution rate. Every company is required to contribute epf for its employees made up from the employee s and employer s share and to remit the contribution sum to kwsp before the 15th day of the following month. For employees who receive wages salary exceeding rm5 000 the employee s contribution of 11 remains while the employer s contribution is 12. Effective from january 2018 the employees monthly statutory contribution rates will be reverted from.

The new employer s share contribution rate is effective beginning january 2012 that is for wage salary received by an employee for january 2012 epf contribution for february 2012 and thereafter. The minimum employers share of epf statutory contribution rate for employees above age 60 who are liable to contribute will be reduced to four 4 per cent per month while the employees share of contribution rate will be zero per cent. Under epf the contributions are payable on maximum wage ceiling of rs.

For sick units or establishments with less than 20 employees the rate is 10 as per employees provident fund organisation s epfo guidelines. The 7 contribution rate will take effect from 1st april 2020 until the end of 2020 and it will be applicable to all epf members under 60 years of age that are subject to statutory contribution. To pay contribution on higher wages a joint request from employee and employer is required para 26 6 of epf scheme.

Employees who receive wages salary exceeding rm5 000 the employee s contribution of 11 remains while the employer s contribution is 12. Monthly contribution rate third schedule the latest contribution rate for employees and employers effective january 2019 salary wage can be referred in thethird schedule epf act 1991 employers are required to remit epf contributions based on this schedule. Also as per budget 2018 the rate of interest applicable on epf is 8 65.

During this period your employer s epf contribution will remain 12. For members aged 60 years and above the employees share of contribution rate will remain at 0. Welcome to i akaun employer i akaun employer user id.